Effective 1 July 2017, premium pricing for Motor Comprehensive; and Motor Third Party Fire and Theft products will be liberalised where premium pricing will be determined by individual insurers and takaful operators.

Effective 1 July 2017, premium pricing for Motor Comprehensive; and Motor Third Party Fire and Theft products will be liberalised where premium pricing will be determined by individual insurers and takaful operators.

Effective 1 July 2017, premium pricing for Motor Comprehensive; and Motor Third Party Fire and Theft products will be liberalised where premium pricing will be determined by individual insurers and takaful operators.

The liberalisation of motor insurance means that the price of motor insurance products will no longer be determined based on Motor Tariff (a set fixed price list). Pricing will be determined by individual insurers and takaful operators.

Consumers will now be able to enjoy a wider choice of motor insurance products at competitive prices as liberalisation encourages innovation and competition among insurers and takaful operators.

Insurers and takaful operators are able to charge premiums that are in line withbroader risk factors inherent in a group of policyholders being insured; and also sell new products that are not defined under the tariff.

Insurance premium is calculated based on the sum insured and model of the vehicle. Additionally, insurers are allowed to apply limited premium loading based on the age of the driver and the number of accidents on record. Depending on the driver’s claims history, the calculated premium to be paid is adjusted against the discount (No Claim Discount or NCD).

Typically, drivers with good driving records can enjoy a higher percentage of NCD up to 55%. However, the driver may experience receiving different quotes from different insurersdue to other factors mentioned above.

Effective 1 July 2017, under the liberalised environment, more risk factors will be taken into account in determining premiums. Other than the sum insured, cubic capacity of the vehicle engine, age of vehicle and age of driver, premiums may be driven by other factors.

These factors could be safety and security features in the vehicle, duration that the vehicle is on the road, geographical location of the vehicle (in areas with higher incidents of theft) and traffic offences on record.

These factors will define the risk profile group of the policyholder which will determine the premium. As different insurers and takaful operators have different ways of defining the risk profile group, the price of a motor policy would differ from one insurer to another.

The first phase of the Liberalisation of the Motor and Fire Tariff was introduced on 1 July 2016. During this initial phase, insurers and takaful operators were given the flexibility to offer new motor products and add-on covers that were not defined under the existing tariff.

From 1 July 2017 onwards, premium rates for Motor Comprehensive; and Motor Third Party Fire and Theft products will be liberalised where premium pricing will be determined by individual insurers and takaful operators.

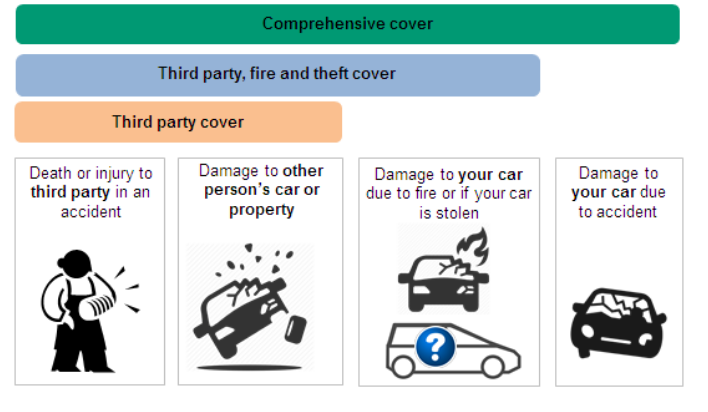

However, premium rates for Motor Third Party product will continue to be subjected to tariff rates.The existing motor products and coverage are:

Consumers should consider the following points when buying insurance:

Yes, you can still purchase additional products to enhance the insurance protection for the same motor vehicle. Alternatively, you may purchase new motor products that meet your needs, to replace the existing motor insurance coverage for the remaining coverage period.

Before terminating your existing motor insurance coverage, please contact your agent, insurer or takaful operator to find out the pro-rated amount of the premium paid which will be refunded to you by your insurer or takaful operator.

Do make informed decisions by shopping around for differentquotations by contacting the agents, insurers or takaful operators through their call centres or online channels before you make your purchase

The premiums charged will be based on the policy anniversary date (the date which your motor insurance policy expires) of the motor policy.

Motor Third Party insurance product is still available for consumers who want to purchase basic motor insurance cover at tariff rate.

The NCD structure will remain unchanged and continue to be transferable from one insurer or takaful operator to another. You will be entitled to the NCD which you are eligible for.

You are advised to always check with your insurer or takaful operator or the agent on new products and add-on covers introduced.

Do shop around to make informed purchasing decisions by obtaining differentquotations by contacting the agents, insurers or takaful operators through their call-centres or online channels.

FAQ on accident assist about roadside assistance towing services information

Accident Assist would be able to answer basic or common enquiries relating to your motor claims. However, if you wish to obtain guidance specific to your motor insurance/takaful policy/ certificate or claim, Accident Assist will connect you to the relevant insurer/ takaful operator who will be able to provide in-depth guidance to you.

For consumers, this benefits include:

To provide one stop service to meet customer needs and exceed customer expectations through an excellent service

YOURCHOICE INSURANCE SERVICE

41A, Jalan Ambong 2,

Kepong Baru,

52100 Kuala Lumpur

Tel: 603 – 6251 3757

Fax: 603 – 6242 1396

Hp: 6012 – 228 8318

Hotline Number: 1700 81 2525

Email: enquiry@yourchoice.com.my

About Us

YOURCHOICE Insurance Sevice (YCS) established in 2007 has a very good strength relationships with a multitude of top-rated insurance companies in MALAYSIA, with a long list of and never ending customer support we are able to guarantee a very high level of satisfaction for our clients .